I am embarrassingly late to understanding the current macro situation, Bernanke’s response and likely outcomes. Two interesting papers are here:

How the Economic Machine Works, Dalio

US Household Deleveraging and Future Consumption Growth, Federal Reserve Bank of San Francisco

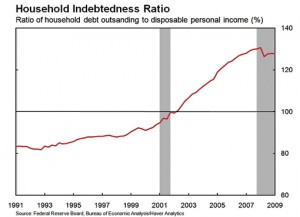

Ratio of Personal Debt to Income

The ratio of personal debt to income is the key to understanding the current situation, responses and consequences.

When this ratio is too high consumers have to pay down debts (deleverage) before they can begin consuming again.

The raw household debt numbers are here, look for 2001 levels of about 8,000 as significant:

GDP

70% of US GDP growth comes from growth in consumer spending, so when consumers deleverage, consumption drops and GDP growth falls.

Falling GDP growth means slower job creation (we currently need about 2% gdp to stay even on job creation because of population growth)

Deleveraging

Deleveragings appear to work if debt to income falls back below 100%, page 43 Dalio (my interpretation)

Deleveraging appear to fail if debt to income continues to rise (Japan), page 39 Dalio (my interpretation)

Bernanke

Bernanke is trying to reflate the housing and stock markets which will decrease the debt to income ratio of us consumers.

The year 2018 for the end of this process comes up in the linked Federal Reserve of San Francisco report.

Conclusions:

Economic data that shows the ratio of household debt to income declining, especially sequentially, will be Risk On

Economic data that shows the ratio of household debt to income increasing or staying constant will be Risk Off

We will be in a trading range as the markets discount whether we are in a failed (Japanese) or successful deleveraging

–h

Henry Carstens

503-701-5741

carstens@verticalsolutions.com