How to Build a Six Month Forecast

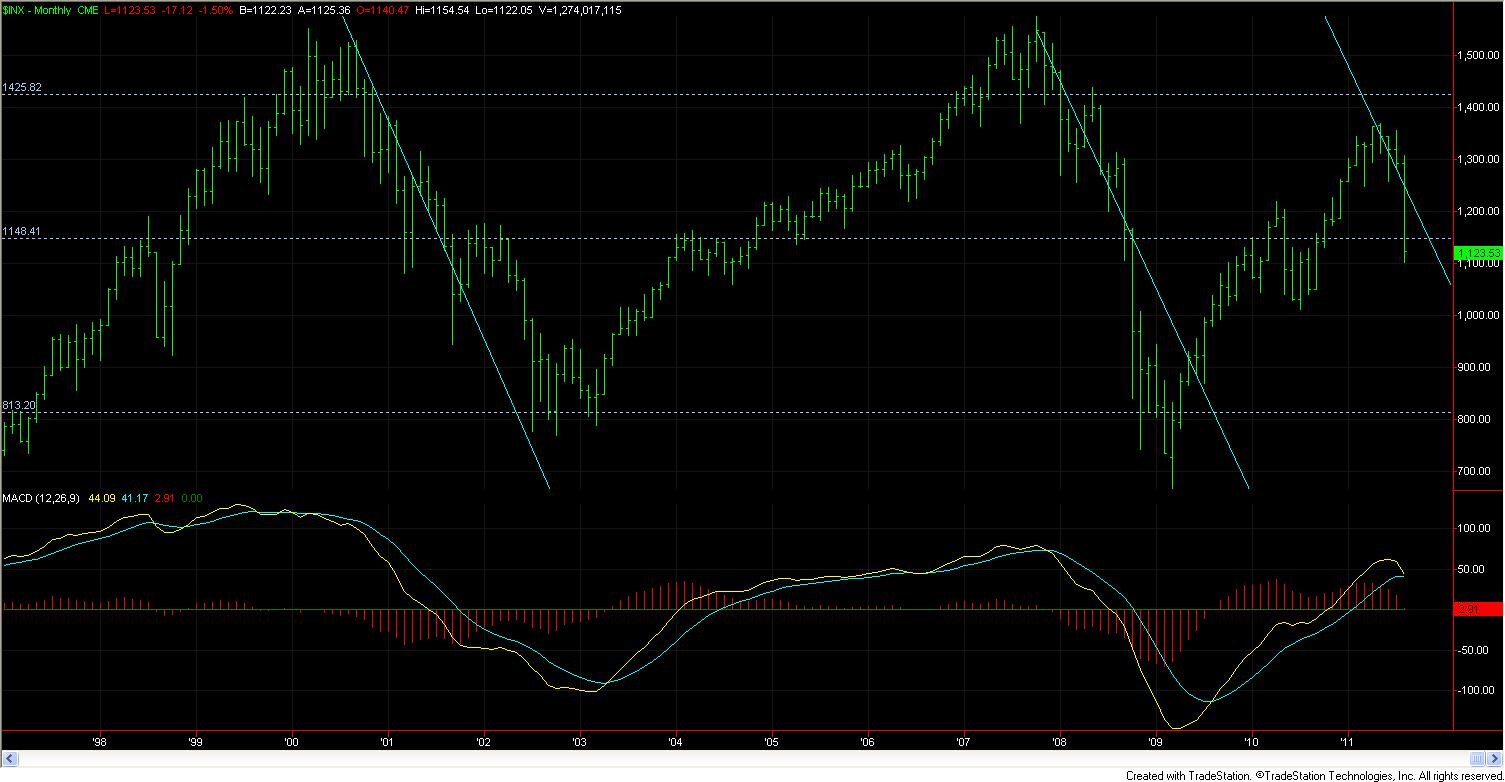

Chart of SP Cash, 1997-8/19/2011

Introduction

The easiest way to build a forecast, is to tie it to event(s) a similar magnitude and then extrapolate using the Forecaster's Law of 2's. As an example, we'll use the 2000 and 2007 highs to build a 'first-forecast' around the big events of mid-2011.Forecaster's Law of 2's

It's okay for this type of forecast to be wrong. The real goal is to gain insight into big events and start buiding parameters and context that can be used for deeper insights and better subsequent forecasts.

You can gain at least a bit of insight into big events by multiplying or dividing the 'things' around an event by 2, i.e., everything takes half as long as it did the first time - a more general Moore's Law w/ an inverse - as we'll see below...

Narrative (some context, justifications and orders of magnitude):

In 2000, the tech stocks diedExtrapolations:

In 2007, the world's financial institutions died

In 2011, western civilization is dying

Peaks:ConclusionTwin Peaks: 2000 to 2007 was 8 years, so the next peak by the Law of 2's should be that duration divided by 2 or 4 years awayDurations (peak to trough):

Peak due: 2007 + 4 = 2011First: 3 yearsTrough Bottoms (simple extrapolations of bottoms):

Second: 1 year (faster than the expected 1.5 years - the prior duration of 3 divided by 2)

Next Trough due: 6 months after last peak, or the prior duration divided by 2, or in 6 months around Feb 2012)First: 800

Second: 800

Third: 800...but...since the 2011 peak was 200 pts lower than 2000 and 2007 peaks, the bottom should be 800 - 200 = 600 (around Feb of 2012)

Using The Law of 2's is an easy place to start when building a 'first-framework' forecast and context around big events. And even if a sample size of 2 is vanishing small, it is at least a look into big events and the start of context. Additionally, we now have information the other guy doesn't have. We know just a little bit more. And that's an edge.