How to Build a Simple Swing Trading System

A swing trading system trades the swings between market highs and lows. Any time frame can be used to define the swings. This paper uses the discovery of a multiday anomaly in the S&P futures (see Testing for Changes in Market Structure) to build a simple swing trading system.

Calculation of the swing point can be quite intricate but starting simply by using a close surrounded by two lower closes as a swing high and a low surrounded by two higher closes as a swing low, is a good place to start.

For buying and selling rules, from the paper "Testing for Changes in Market Structure," it looks like there's an edge when a higher swing high or a lower swing low forms, so...

The entry rule for the swing systems is:

- Buy after a swing high higher than the prior swing high

- Sell after a swing low lower than the prior swing low

The expanded entry rule for the swing systems is:

- Buy after a swing high higher than the prior swing high at the 2nd most recent swing low

- Sell after a swing low lower than the prior swing low at the most recent swing high

- Exit longs on the first profitable close or after 3 days, and

- Exit shorts on the first profitable close or after 3 days

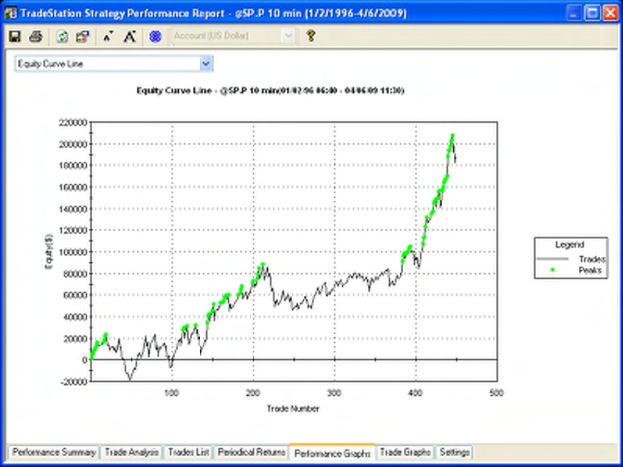

- 346/449, 77%, avg 1.7 pts, sd 18.0 pts, t 2.0

All it lacks are stops and maybe a filter or two. (The filters are hinted at in Testing for Changes in Market Structure. Note again how well the simple choices worked at each decision point in designing the system.

This example highlights the bottom-up approach to designing trading systems: find an anomaly and then build a trading structure around it.