Using 'or' instead of 'and', 08/20/05

Here's a simple system we'll improve using 'or' to broaden its scope instead of using the more traditional 'and' which narrows scope:

Buy on the close if the normalized MACD is < -2

Exit after two consecutive up open-to-closes

From 1997 to present in the SP futures this system was:

45/66, 68%, avg 5.3 pts, sd 24.4, z 1.8

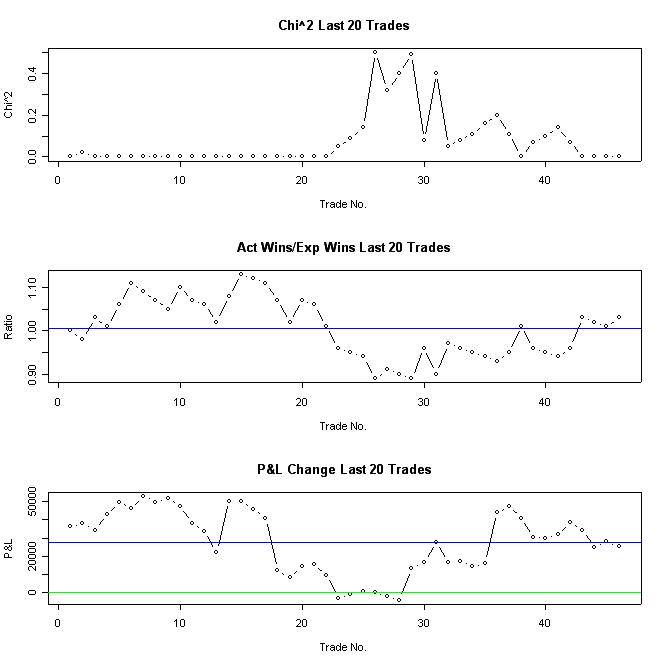

A statisticaly significant system with stable control charts:

But with only 66 trades over 8 years there's really not enough meat for a meal so we'll use 'or' to increase the number of trades and to run a psuedo out-of-sample test on the original system.

You may have noticed that all oscillators like MACD behave similarly, so add the following parameters to the system:

Buy on the close if:

normalized MACD < -2 or

normalized Sharpe Ratio < -2 or

normalized ROC < -2 or

normalized Stock/Bond Ratio < -2

Exit after two consecutive up open-to-closes

From 1997 to present in the SP futures this system was:

83/118, 70%, avg 4.9 pts, sd 27.6, z 1.9

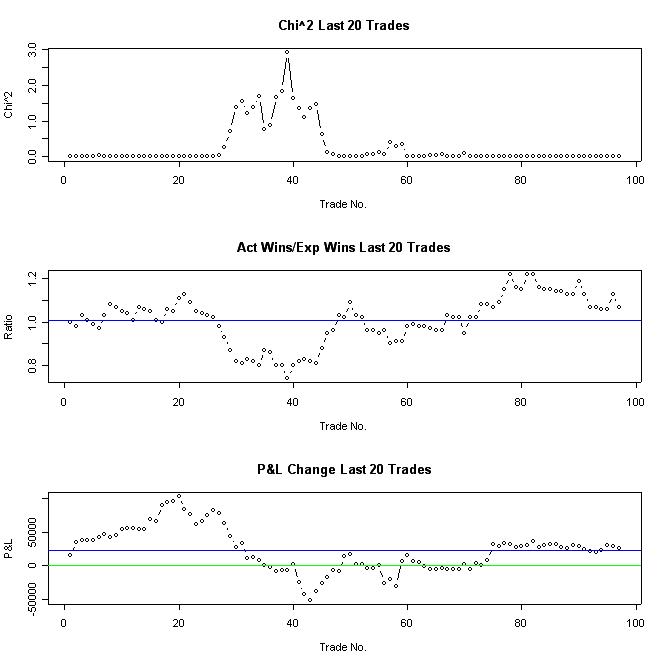

Again a statistically significant result with even better looking control charts:

Using 'or' improved the original system in two ways:

1) 'or' nearly doubled the number of trades and improved the design's z score

2) 'or' helped validate original concept with a pseudo out-of-sample test as the design continued to work when we added 3 baskets of related signals

Conclusion: 'or' can be applied to many system designs to increase the number of trades, improve profitability and provide additional robustness.